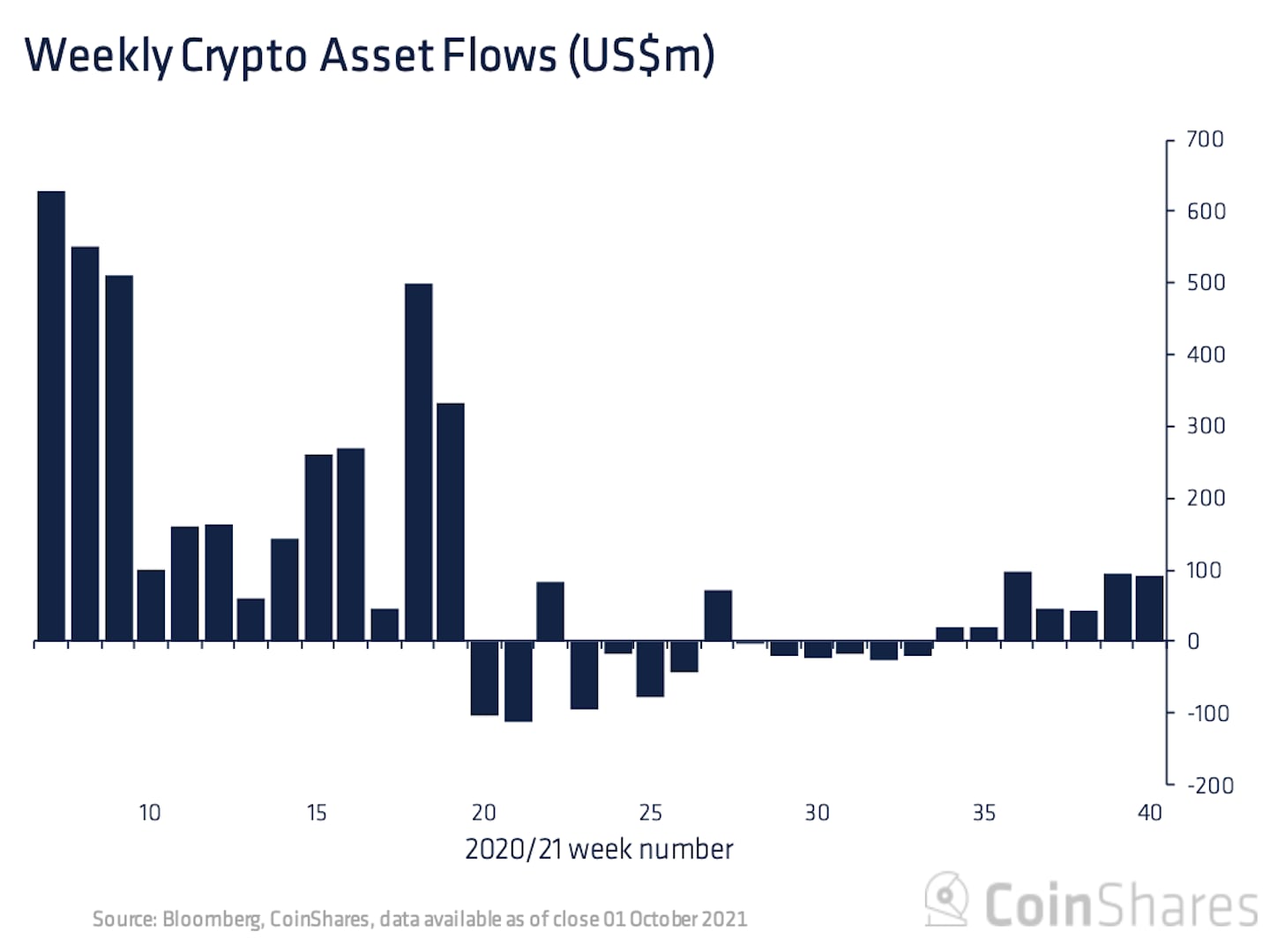

Digital-asset investment products attracted $90 million of new money in the seven days through Oct. 1, the seventh straight week of inflows.

Bitcoin-focused funds alone took in $69 million of investor money, according to a report published Monday by CoinShares. It was the third straight week of inflows for bitcoin funds, pushing the cumulative intake over the period to $115 million and cementing a trend reversal from the prior few months when redemptions were the norm.

“We believe this decisive turnaround in sentiment is due to growing confidence in the asset class among investors and more accommodative statements from the U.S. Securities Exchange Commission and the Federal Reserve,” according to the report’s authors.

Crypto funds focused on Ethereum, the second-largest blockchain, saw $20 million of inflows.

Alternative digital assets appeared to show waning interest. Funds focused on Polkadot, Tezos and Binance’s BNB token saw minor outflows of $800,000 each. Cardano-focused funds saw minor inflows of $1.1 million while Solana attracted $700,000.